How much can I charge as a VA and how do I set my rates?

Your Time And Skills Are Valuable Right?

We can discover your starting hourly rate together.

When you first start out as a VA it can be very difficult to choose a rate, because you feel like you don’t have the skills and experience to charge much.

It’s easy to pluck a number out but let’s do it systematically and a bit more methodical.

LET’S BREAK IT DOWN

Read on to discover what you need to consider first.

Taxes in your country

As a Virtual Assistant, you will be considered an Independent Contractor. This means that you are contracted to perform services for others, without having the legal status of an employee.

Make sure you understand from an accountant what taxes (if any) you will need to pay as an Independent Contractor. This is different in every country so please speak to a qualified accountant.

Expenses and deductions

Write down a list of all the expenses and deductions you need to run your business.

What will be your costs each month to run your business (don’t add paying yourself).

You might not know this until you start working.

Make sure you keep all receipts and record everything for tax time. It might be helpful to open another bank account you use just for business expenses and income. This makes tracking things so much easier. Rather than having to go through your personal accounts and find the transactions that relate to your business.

As always, it’s best to talk with a tax professional regarding your individual situation.

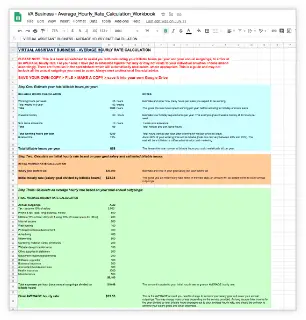

I have created a spreadsheet to assist you with calculating your billable hours per year and your annual outgoings, to arrive at an AVERAGE hourly rate. Get your hands on this spreadsheet in the masterclass here.

What do you need to pay yourself?

What is the minimum viable amount you need to contribute towards your household? Work out what is the minimum wage you need to pay yourself each week or month.

If this is too high – can you reduce your expenses?

Or what is the goal you want to work towards?

Add your expenses and wage together.

This is the amount you’ll want to make. Subtract any taxes you’ll have to pay.

Here’s an example:

If you are planning to have your Virtual Assistant business be your main source of income, it’s a good idea to determine your rates by working backward from what you need to make.

So, let’s say you make $4,000 (gross income) in a month from your VA Services.

FYI: Gross income means the total income before business and tax deductions are accounted for.

Now – you’ll want to save about 30% back for taxes if you’re in the US for example.

You made $4,000 last month? You’ll save around $1,200 for taxes, leaving you with about $2,800 remaining.

Need to take home $4,000 each month to cover your bills, fees and expenses?

You might need to bring in more each month in gross profit. Or look at reducing your expenses.

Remember – we are talking about coming up with an ideal hourly rate for you. We are simply determining your base VA rate and monthly budget.

To really grow your business and skyrocket into making 5k-10k months and beyond, you can eventually start subcontracting some of the work that you do and targeting high-end clients with specialised services.

How many hours are you able to work?

Reverse engineer it – look at how much your expenses are each week – how many hours will you need to work to cover those costs. If you don’t have enough – decrease your expenses or increase your prices. But you can’t increase your prices if you’re a new VA and you don’t have much experience at the beginning.

You don’t want to overbook yourself – take on too many clients then can’t do the work. That’s really damaging to your reputation and brand.

Take it one client at a time – it’s good to start slow, take on one client and then see how you go for time, then take on another, then another and you will soon realise how many clients you can take on. Re-calibrate everything.

Got time for your own biz too? Make sure you set aside time for your own biz like invoicing, social media and finding clients. I recommend at least 5 hours per week for your own business.

VA side hustle – work as a VA as a side hustle while you have your ‘normal’ job. This will also give you a chance to see if you like being a Virtual Assistant before quitting your job.

Now it’s time for real talk

Having a business and being an entrepreneur is not easy. It takes determination, being proactive and dedicated to putting in the work. But it’s so rewarding at the same time.

THERE ARE MORE PROS THEN CONS

But in my opinion the pros out-way the cons – you have the freedom to work when you want, charge what you want, work with who you want and take holidays when you decide.

MAP OUT YOUR HOURS

Block out the time in your calendar or planner and decide on the hours you are going to work on your biz and let that time be non-negotiable for change. Now map out the hours you’ll be working with clients.

Let’s calculate your rate

So – you’ve figured out how much to need to gross per month when factoring in taxes to meet your monthly budgeting needs.

You’ve also planned out how many workable hours you will have each week to meet your goals.

Now, we will use this information to determine your rate.

Let’s say you can commit 40 total hours per week to your business. We will subtract 5 hours for you to work on your business.

Now, you have 35 workable hours per week. That’s roughly 140 hours per month that you can be making money in your business.

We will use this simple formula to discover the rate you should be charging:

GROSS INCOME NEEDED + BILLABLE HOURS PER MONTH = HOURLY RATE

HERE’S AN EXAMPLE

$4,000 Gross Income Needed / 140 Hours = $28.57 but let’s round it up to $30 per hour

Maybe you’re only able to work part-time on your VA business. We can also work backward to find out how much you could make starting out as a VA.

Let’s meet Jessica.

Jessica has 20 hours per week to commit to working.

She’s going to spend 5 hours per week on her business doing social media, invoicing, updating her website, finding clients, admin etc.

That means she has 15 hours each week to commit to working for clients. That’s about 60 hours per month.

She is just starting out, so a rate she feels comfortable charging is $27 per hour, at least for her first clients.

60 Hours Per Month x $27 per Hour = $1620 Gross Income

If you need to subtract the 30% you’ll need to save back for taxes.

$1620 x .3 = $486 to save. That leaves you with $1,134 net income for the month!

Pricing standards

You can work at a reduced rate while you learn.

Or you can work for free for a couple of weeks, or 1-2 tasks in exchange for a testimonial.

If you can’t decide where to start with your rates for general admin work, take this advice…

Start out at the lower end and get your first client.

Then, with each new client, increase your rates to $2-$5 more. And so on with each client.

As your skill and confidence grows, so too does your rate.

Need to know more about how to create your prices and packages?

Sign up to this masterclass to learn:

- Expenses and deductions

- What you need to pay yourself

- How to work towards your dream income goal

- How many hours you can work

- How working as VA can be your side hustle

- How to calculate your rates

- Pricing standards

- And so much more!

Your time is valuable. Make the most of it, and educate yourself a bit further with this masterclass, so that you can achieve your goal income!